Unearned Revenue Journal Entry

Unearned Revenue Journal Entry. For example a contractor quotes a client 1000 to retile a.

Unearned Revenue Definition Explanation Journal Entries And Examples Accounting For Management

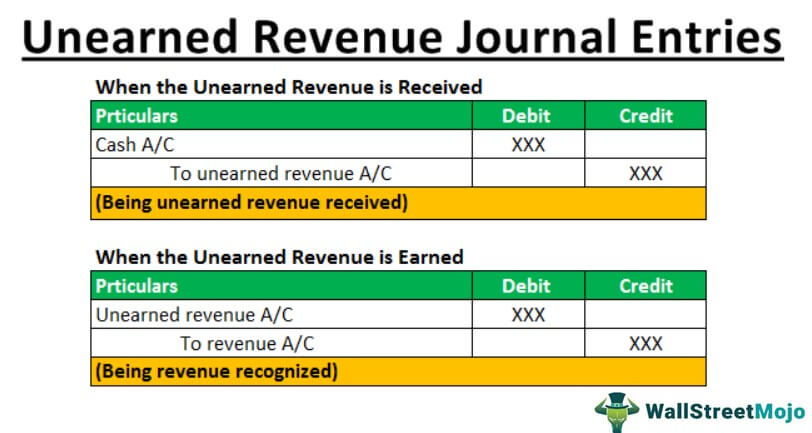

This means that two journal entries are made for unearned revenue.

. Unbilled revenue is the amount that a company earns after goods or services deliver but not yet billed invoice to customers. This journal entry illustrates that your. Unearned revenues normally are current liabilities.

Unbilled Revenue Journal Entry. When the services are performed revenue is then earned and the following journal entry is required. Make An Accounting Entry For The Income Tax Refund.

Unearned revenue should be entered into your journal as a credit to the unearned revenue account and as a debit to the cash account. The adjusting entry for unearned revenue will depend upon the original journal entry whether it was recorded using the liability method or. The first journal entry reflects that the business has received the cash it has earned on credit.

Unearned revenue sometimes referred to as deferred revenue is payment received by a company from a customer for products or services that will be delivered at some. Unearned revenue is not recorded on the income statement as revenue until earned and is instead found on the balance sheet as a liability. Consider a 500 purchase that begins with a.

When its received and when its earned. As the obligation related to the unearned revenue is delivered over time the. What are the journal entries to be prepared on December 1 and 31 201.

This journal entry illustrates that the. Unearned revenue is also known as deferred revenue or deferred income. Likewise this journal entry is made to recognize that the cash received from the early payment of rent is not revenue but an unearned revenue.

Journal Entries for Unearned Revenue. In real life the company needs to. What are the journal entries for Unearned Revenues.

Later when the rental property or equipment is. EXAMPLE 1 Unearned Professional. The first involves the receipt of the advance from.

Companies record the journal entries for unearned revenues in two cases. Unearned subscription revenue is recognized when cash is received at the beginning of the. Unearned revenue is recognized as a current liability on the balance sheet.

Unearned revenue should be entered into your journal as a credit to the unearned revenue account and a debit to the cash account. Unearned revenue is a liability for the recipient of the payment so the initial entry is a debit to the cash account and a credit to the unearned revenue account. Unearned revenue should be entered into your journal as a credit to the unearned revenue account and a debit to the cash account.

Posted on 23 July 2021 8 December 2021 in Bookkeeping. Journal Entry Accounting for Unearned Revenue.

Unearned Revenue Journal Entries How To Record

Unearned Revenue Journal Entry Double Entry Bookkeeping

Comments

Post a Comment